What drives customer behaviour for a home loan?

The housing finance market has always been a very competitive market place post deregulation in the 1980’s and the advent of Aussie Home loans and Wizard changed our home and investment loan marketplace forever.

And now today in our marketplace we keep seeing digital popups and start-ups trying to add competition to our market.

Home lending continues to be dominated by the Big 4 (CBA, Westpac, NAB & ANZ) but the competition is there and people have many more choices today than they’ve ever had.

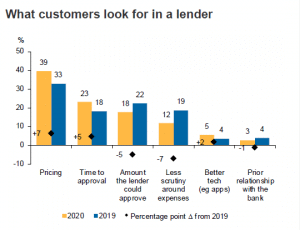

And with choice, it changes our behaviours and what we want from a home lender as a recent survey conducted by Macquarie Wealth Management into what people are looking for in home lenders and the results have been very interesting in relation to year on year responses as well as what people deem most important.

Impact

The key findings from the survey are:

- Pricing and turnaround times (time to approval) were perceived as key drivers for selecting a lender;

- Approval times deteriorated further in 2020 (contrary to the feedback from banks’ management), driven by various back-office issues and banks struggling to cope with increased refinancing volumes;

- Prior relationship with the bank had little impact on customer’s lender selection, suggesting customer retention is becoming increasingly difficult without matching competitor’s offers;

- Mortgage brokers responded that on a weighted average basis ~40% of customers borrowed close to their maximum capacity;

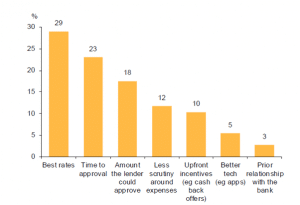

- As cashback offers increasingly drive flow, we believe banks are potentially sacrificing their long-term returns, given ~53% of respondents indicated that cashback recipients were more likely to churn; and

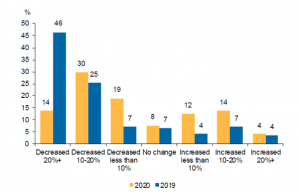

- Maximum borrowing capacity for owner-occupiers increased by ~5%, while for investors, it decreased by up to ~20%. As a result, we observed a convergence between the maximum borrowing capacity for Investors and Owner Occupiers (the difference has now ~10%).

Some of these findings seem to show a maturity in how we approach home lending. Primarily peoples previous relationships with lenders having a very low impact as people search for the best offering.

And it’s also interesting to note that people aren’t just choosing a cash back offer as we recently wrote about but considering their whole position first and then if a cashback offer is included, treating that as a bonus but not a reason to refinance or apply with that lender.

The vast majority of customers’ primary focus when considering lenders was on pricing and lenders ability to approve and settle the mortgage within “acceptable” timeframes. In other words, people want the right price and also expect a timely result in terms of lender performance and service they are offered.

And when people were asked what they felt about the borrowing capacity and ability to borrow over the past 12 months, their thoughts were:-

This really emphasises my point recently about why people need to be able to borrow to boost spending and therefore help resurrect our economy.

So there you have it, if your lender can provide you with the right borrowing capacity, can offer it at a reasonable price (interest rate and/or provide cashback) and do it in a timely fashion then lenders will continue to secure business and if not, well you can’t say we didn’t tell you so.

- Choosing the right mortgage solution of variable fixed or both - October 8, 2024

- All You Need to Know About Bank Valuations - September 20, 2024

- Getting the Most out of the Spring Property Season - August 26, 2024