Timing the Market vs. Time in the Market

The amateur real estate expert.

They’re the person who boasts about buying a property at its lowest possible price and then selling it again for the maximum possible amount, right before the market turns. The implication is that they’re geniuses with some kind of innate ability to read the economic tea leaves and sense the absolute perfect time to get in and get out. And boy, no need to guess that they’re doing well out of it, because they’ll tell you within the first minute of a conversation.

I’m sure some do indeed do well, at least some of the time. A broken clock is wrong twice a day, after all. But what I find frustrating about those who boast of being able to ‘time the market’ is that some listeners might find the idea intoxicating.

It’s understandable at the moment, after a particularly hot few years in Australian real estate, but I worry it’s giving people a false senses of security.

Trying to time the market is a fool’s errand and one that has been shown time and time again to fail more often than not. Those investors have a blinkered view of the market because they’re stuck focusing on the now and not the bigger picture. They think they’re smart, and sometimes they might be, but the truly wise investors know that the best decisions are those made with a long-term view.

Patience is a virtue. That’s especially true in property investing.

The problem with short-term thinking

There was social pandemonium. No-one knew how long this thing was going to last and what kind of impact it would have, but the dramatic upheaval of normal everyday life was chilling.

And we were warned there would be hefty consequences.

Economists, commentators and even the major banks warned of an economic Armageddon. Double-digit unemployment. A collapse in fiscal growth. And in the property sphere, value losses of up to 20 per cent – one lender even tipped a 30 per cent price crash.

Of course, as we know now, not many of those dire predictions panned out. But if you were a so-called ‘savvy’ investor who subscribed to the theory of timing the market, you probably would’ve cashed out.

When you’re only in it for the short-term, why hold onto an asset that’s about to bleed out?

That kind of seller would’ve missed what happened barely five months later – the beginning of an extraordinary upswing in values. From trough to peak, median prices surged by up to 30 per cent in some areas. It was unbelievable.

The value of a long-term approach

Even in particularly frenzied markets, there is somewhere in the vicinity of 550,000 to 600,000 real estate transactions in a year. That sounds like a big number, and it is. That’s a lot of money changing hands. But in the broader context of the total housing market, that’s a tiny fraction. There are almost 11 million residential dwellings across the country, so in a hot year, about 5.5 per cent of homes are subject to immediate market conditions.

Smart investors with a long-term focus don’t sweat the dramatic headlines or the earnest commentary about whether prices are up or down this month. They know that over time, their asset is going to appreciate in value.

The research house CoreLogic conducted analysis on this very topic back in mid-2022 and the numbers are astounding.

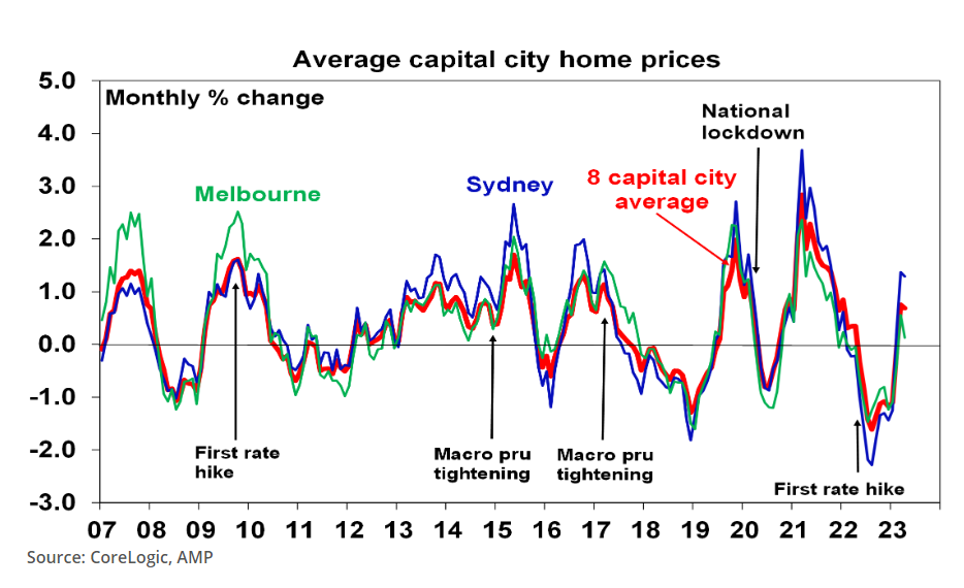

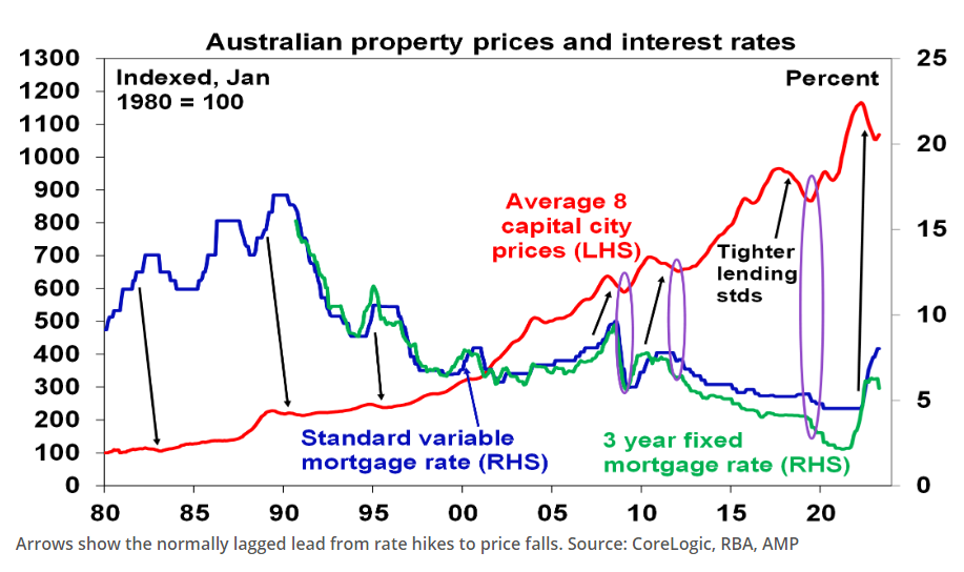

Over the past three decades, there have been six identifiable cycles of growth and six cycles of decline. Some of those upswings and downswings were sparked by political upheaval or policy changes, while others kicked off with a little help from a financial meltdown.

But each ended. Every period of loss eventually eased, bottomed out, and began a recovery. And while the same could be said for growth cycles – those six also plateaued and declined – it wasn’t long, in the grand scheme of things, before the moving line was back in the black.

When you take off those blinkers and you zoom out, the numbers are clear. Up and down cycles come and go, but over the long-term, the direction of movement is up.

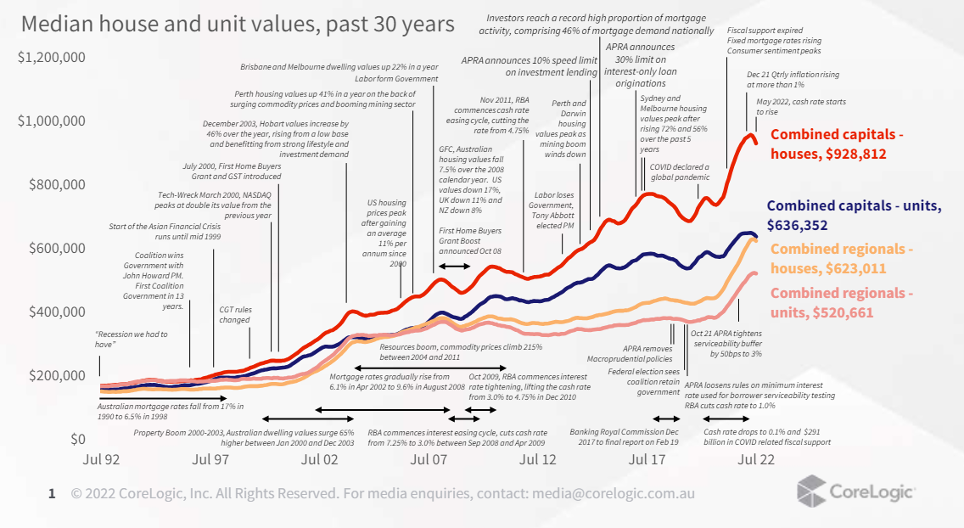

As CoreLogic’s analysis showed, home prices rose a staggering 382 per cent over the past 30 years, averaging about 5.4 per cent per year since 1992. That’s incredible.

Even when broken down into decade chunks – the average time a person holds a property in this country – the data is clear. Between 1992 and 2002, in the aftermath of a recession, in the midst of extraordinary political and policy upheaval, and with the September 11 terror attacks, home values surged by 77 per cent.

In the decade after, between 2002 and 2012, when we had major global conflicts involving Australian troops, political upheaval, a Global Financial Crisis, and the Rudd-Gillard-Rudd revolving door of prime ministers, prices rose by 59 per cent.

And between 2012 and 2022, during which the gap between rich and poor began to really widen, when America elected Donald Trump, Australia had about a dozen other prime ministers, and Covid brought the world to a standstill, values were up 72 per cent.

If in any of those decades you’d decided to focus on the short-term and react to something in the here and now, you would’ve missed out on bucketloads of growth.

Investing for the long-term outperforms short-term speculation. Be patient. The numbers don’t lie – it’s well worth it.

Knowledge Hub Updates

- Choosing the right mortgage solution of variable fixed or both - October 8, 2024

- All You Need to Know About Bank Valuations - September 20, 2024

- Getting the Most out of the Spring Property Season - August 26, 2024