Mortgage Offset Account Explained

Your introduction to offset finance

Once you have bought your home, there are ways that you can minimise the interest you pay over the life of the loan. This can include making additional lump payments or repaying the loan fortnightly instead of monthly. One of the most popular ways, however, is to establish a mortgage offset account, which will reduce the interest payable on your home loan depending on the savings you have in your offset account.

A mortgage offset account is separate to your home loan, so therefore, it needs to be established with the same lender.

The way it works is that any savings that you have in the offset account reduce your total loan amount, which in turns reduces the interest you need to pay. For example, if your home loan is $500,000 and you have $15,000 saved in your offset account then your monthly or fortnightly repayments will be calculated on $485,000.

As you can imagine, if you can keep a certain amount in your offset account then the total interest payable over the life of your 25- or 30-year-old mortgage can be reduced significantly.

Benefits of offset finance

An offset mortgage account can be beneficial to both homeowners and investors if they are disciplined.

One of the major advantages is due to the fact that the interest rate on your home loan is generally higher than what you can earn in a savings account. Many people deposit their tax refunds, salaries or other lump sum cash payments into an offset account so their home loan is continually lower than it would have been without these additional funds offset against the loan.

While offset accounts can benefit all property owners, there can be particularly helpful for investors. Investors may be able to claim a tax deduction for interest paid on their investment property loan if it is clear that the loan’s purpose is specifically to fund the investment property.

However, investors could inadvertently change the loan’s purpose if they deposited additional funds into their mortgage to reduce interest payments, then later withdrew those extra funds for another use.

With an offset account, deposits and withdrawals can be made without the purpose of the loan being affected.

While an offset account can benefit everyone, it is particularly useful for people who may have large cash savings or are paying the highest tax rate.

This is because if you leave any savings in an account in which you earn interest, you will likely have to pay tax on those savings. With an offset account, however, you don’t earn any interest on those savings – in fact, you’re saving money on your home loan – so there’s no tax to pay.

What to look for in an offset mortgage

There are hundreds of loan products on the market, tailored to a variety of different uses.

You can get loans with mortgage offset accounts for regular home loans, property investment loans and even for construction and renovation purposes but not all loans are created equally.

Some of the key features to look out for in a mortgage offset account include a no balance limit that allows you to use it like a regular savings account until the balance increases to offset the property loan; a facility that offsets 100 per cent of your balance against your loan, calculated daily to maximise the financial benefits; and one that has an interest rate that is the same as your property loan and moves in line with any changes to that interest rate as well.

How does it work in real life?

Let’s now take a look at how mortgage offset accounts work in real life, because you may well be surprised at the savings you can achieve by establishing one.

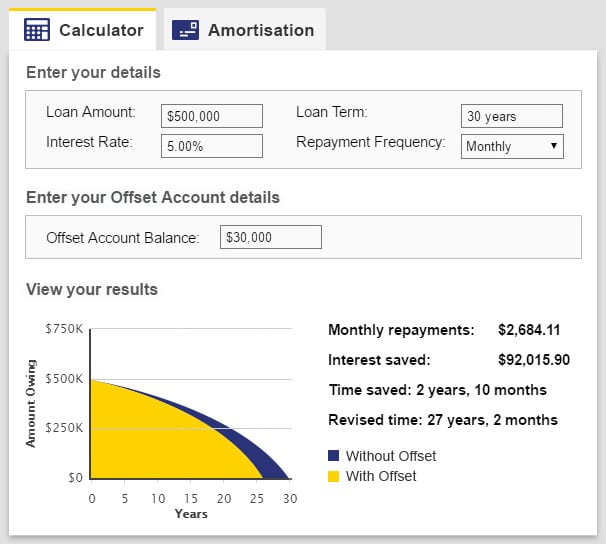

Keeping the previous example of a $500,000 home loan but perhaps with savings of $30,000 in a mortgage offset account that is your six months’ cash flow buffer to see you through any financial difficulties such as unexpected illnesses or job loss.

Using this example, with a five per cent interest rate, a loan term of 30 years, monthly repayment, and a consistent $30,000 in your offset account you can making significant savings over the life of the loan.

Home loan offset calculator

Using a mortgage offset facility, with a $30,000 balance, you can save a huge $92,000 of interest over 30 years and reduce the time of the loan from 30 years to just over 27 years. You can create different calculations for your own personal financial situation by using a mortgage offset calculator.

It’s important to remember, however, that you need to disciplined, and not spend the savings you have in the offset account because any additional monies you have will reduce the total interest paid.

Using a credit and debit card with an offset account

If your loan has an offset account attached to it, it may be worth asking your lender if there is a debit card you can link to it. People with offset accounts linked to their savings accounts or debit cards may have the ability to withdraw cash.

This option is particularly useful for people who may have their salary deposited into their offset account because even though they will likely need to use these funds for their everyday living expenses, interest is calculated on the balance of your loan and offset daily so it will still reduce the total interest payable.

However, having a debit card can be risky because it can provide ready access to funds, especially for impulse purchases, which are better served staying in the offset account than buying a new pair of shoes or a tropical holiday.

Another option that many people use is to have a credit card, which that use for all of their expenses and is paid off in full every month from the additional savings in the offset account.

Again, this is a good option for diligent savers, as it’s likely that the total credit card debt every month is reasonable and has already been budgeted for out of their salary or wages.

The point is that by keeping those additional funds in your offset account for a month, it will reduce the interest payable over that period. Of course, it’s vitally important that your credit card is paid off in full every month so you’re not hit with high-interest rate charges from the card issuer.

Redraw vs. Offset Finance

There are principal differences between redraw and offset finance loans so let’s take a look at each of these now for clarification.

A redraw facility enables you to deposit any spare income you have directly into your home or investment loan account – although it isn’t recommended that you do this for investment loans unless you are on a fixed rate repayment as it may have tax implications. You can then redraw from the loan account any funds that are in excess of your regular repayment schedule.

A redraw account can be very effective if you can foresee some changed circumstances – for instance, you can make additional payments while you have the capacity to be able to pay excess amounts into your loan in preparation for a time when this capacity may reduce.

An offset mortgage account, however, is a transaction account that can be linked to your home or investment loan. The credit balance of your transaction account is offset daily against your outstanding loan balance, reducing the interest payable on that loan.

The main reason Intuitive Finance prefers offset accounts to redraw facilities is that, while it has the same impact on your mortgage as you go, it’s when circumstances change that redraw facilities may restrict your capacity to achieve what you want.

At the end of the day, offset accounts are cash and available to use 100 per cent at your discretion whereas redraw has limitations.

Intuitive Finance – the smart choice

Understanding the many home loan products on the market and calculating which ones will benefit your personal financial circumstances can be tricky. Having a professional team on your side could make all the difference to your success. Now more than ever, you need investor savvy people working on your financial side.

The world of banking and finance can be a pretty daunting one for both novice and sophisticated investors and since our establishment in 2002 we’ve focused on providing outstanding service and business standards.

This approach was vindicated when we were recently named Victoria’s favourite mortgage broker at the 2015 Investors Choice Awards.

Whether you are a homeowner or investor for expert advice on mortgage offset loans and how you can financially benefit from them, contact Intuitive Finance to ensure you start with the right information and expert support on your side.

Further reading

For more information on mortgage offset accounts, whether you’re a homeowner or an investor, consider the following resources:

- How mortgage offset accounts can benefit property investors

- ASIC’s Money Smart guide to choosing the best home loan for your circumstances

- The definitive outline to what you need to know about lines of credit, offset accounts and redraw facilities so you can make the most of your property investments

Disclaimer*

The information provided in this article is general in nature and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information you should consider the appropriateness of the information with regard to your objectives, financial situation and needs.

- Choosing the right mortgage solution of variable fixed or both - October 8, 2024

- All You Need to Know About Bank Valuations - September 20, 2024

- Getting the Most out of the Spring Property Season - August 26, 2024