Is now really the best time to invest in property?

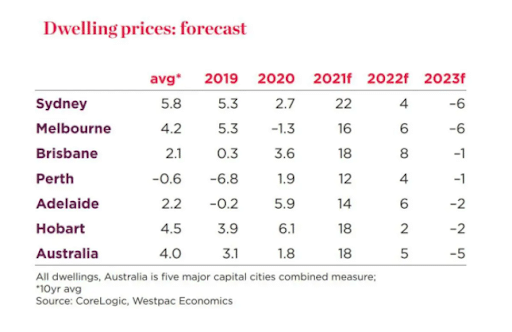

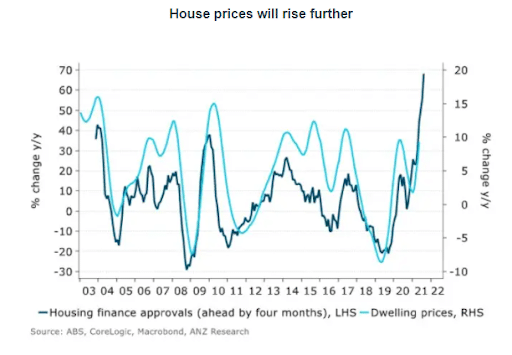

With forecasts for the rest of the 2021 calendar year for property prices to rise by 20%, making the decision to buy Australian property, whether it be a home or an investment property, can be tough, particularly when the market is behaving differently (as it is now) and you’re faced with a choice – buy now or wait until prices cool?

The reality is that it’s very difficult – some say impossible – to time the market to ensure you’re buying when prices are low and selling when prices are high. People’s lives rarely work out that well. It takes time to save for a deposit, it takes time to build equity in your property so you can borrow against it, and, for most, having the capacity to buy comes when it comes. You can’t really control that factor very much.

So, when you’ve finally got the means to buy a property, should you act if the market is hot? Are you hesitating, possibly spooked by the skyrocketing prices and wondering if perhaps you might bag a bargain if you wait a little bit?

Buying an investment property – market conditions

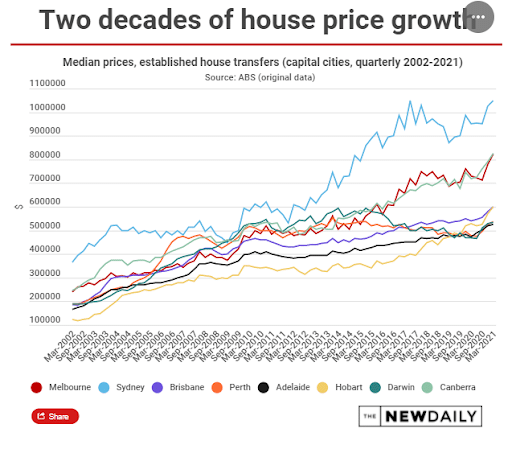

History would show that “Time in” the market is far more important than “Timing” the market.

Property investment is a strategy designed to build wealth. It’s important to understand that investing in real estate is a tool that works best over the long term – mostly that’s at least 7 to 10 years). For most people, owning an investment property is about shoring up reserves for retirement; having an asset that will either be saleable when that cash injection is required, or will deliver a positive income stream.

So, while price is a consideration when buying an investment, it is not the only consideration.

Affordable capital

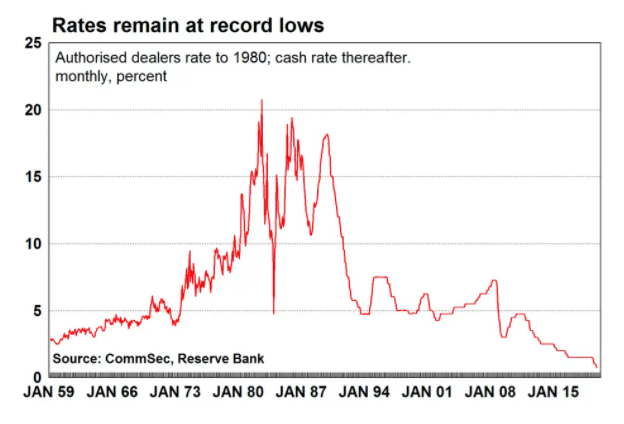

The Reserve Bank of Australia has reiterated its commitment to leave interest rates on hold for the foreseeable future, at the historic low of just 0.1 per cent.

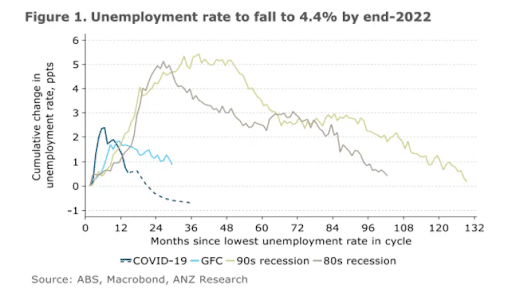

Governor Philip Lowe has given several undertakings over the recent months that these rates will remain in place until the central bank sees inflation hit the magic 2.0 to 2.5 per cent range (it’s sitting at around 1 per cent, as at time of writing, August 2021) and wages growth is at meaningful levels. For this to happen unemployment must be at a consistently low rate for some time, in order to put upward pressure on wages. Unemployment levels, according to the ABS for June 2021, fell to 4.9 per cent, the lowest since December 2010.

However, in May and June of this year, banks started to make changes to their fixed-rate offerings. We saw four-year fixed rate products move up, an indication that many think interest rates will rise within the next four years.

Governor Philip Lowe has said the RBA would not look at moving rates until at least 2024, however, the ‘big four’ banks are positioning themselves for an earlier move, convinced by economic indicators that suggest the economy is rebounding more strongly than the RBA expected.

If the banks are right, and rates are likely to move before 2024, then now is a good time to borrow for an investment property. Borrowing now will give any new investor a couple of years of capital growth before rates tick up.

Vacancy rates

Vacancy rates in Australia’s capital cities are at historic lows. Nationally the market sits at around 1.6 to 1.7 per cent, depending on your data source. This is a very tight market and represents the lowest levels in about a decade.

Sydney and Melbourne vacancies tightened while Brisbane’s remained stable.

In property terms, a vacancy rate of around 2.0 to 2.5 per cent is optimal for a market to operate efficiently. This means that there is enough stock for tenants to find suitable, affordable accommodation and landlords/investors have a selection of good tenants for their property.

When markets begin operating outside these levels, issues arise.

In Brisbane, at present, the tight vacancy rate of just 1.3 per cent means tenants are struggling to find good accommodation options and rents are starting to surge.

In Sydney and Melbourne, where vacancy rates are a little less stretched, rents are holding steady but there are pockets, middle ring suburbs, where vacancies are tight, and affordability is under threat.

Looking ahead

Anyone who makes a prediction about the future of the property market, or migration trends, in the middle of a pandemic is a brave person.

However, if we look at historic trends, we may find clues about what could happen in the future.

Remote working remains a mainstay of the Australian labour force. This has freed people to move around the country and in 2020 we saw regional property prices surge as people left the major centres for the (relatively) COVID-free regions.

New figures from the ABS reveal that net migration away from the capital cities during calendar year 2020 was 43,000 up from 19,000 the previous year.

That phenomenon has slowed now, although, the recent capital city lockdowns of Sydney, Melbourne and Brisbane, may trigger a return to this trend as Australians grow increasingly frustrated with life indoors.

And for those who are waiting for prices to correct, that is unlikely to happen while rates remain low. In New Zealand surging property prices have been tackled by increasing the interest rate and removing negative gearing. We have had clear indications that this is unlikely to happen in Australia, so these conditions are here to stay.

Making a decision

For anyone considering an investment property, the stars are aligning. Low cash rates mean access to affordable (cheap) cash and demand for rental properties is strong.

Look for areas where vacancy rates are falling, such as Brisbane or regional centres within 90 minutes-drive of a capital city. Sydney and Melbourne would be-investors look for those suburbs where rental markets are busy and vacancy rates are tight.

It may be tough getting into the market, and you may need to spend a little more than you’d like to secure that investment property, but once you start your strategy will begin its work and you’ll be on the road to wealth accumulation.

The information provided in this article is general in nature and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information you should consider the appropriateness of the information with regard to your objectives, financial situation and needs.

- Choosing the right mortgage solution of variable fixed or both - October 8, 2024

- All You Need to Know About Bank Valuations - September 20, 2024

- Getting the Most out of the Spring Property Season - August 26, 2024