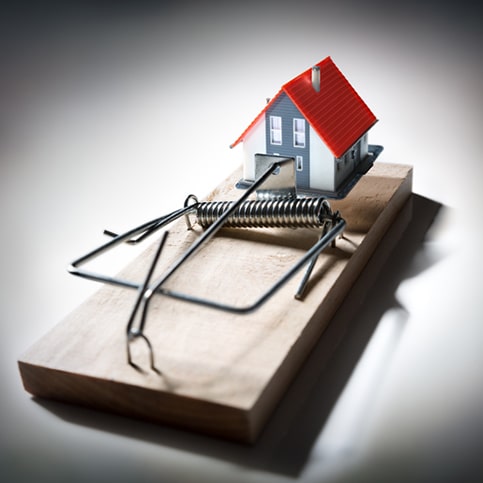

3 ways to pay off your home loan sooner

At some stage in our lives most of us will experience the various highs and lows that go hand in hand with home ownership.

Undeniably today the biggest pressure associated with realising the dream of having a place…