First Homebuyers vs. Investors

As the first wave of COVID reality bit the property market and resulted in a hard stall on activity, governments scrambled to get the engine room of the economy purring again via schemes and incentives. Property has long been recognised as a financial juggernaut, with stamp duty and other taxes filling government coffers and providing plenty of income for a range of housing-related industries.

Those COVID incentives were targeted to first home buyers, offering a great opportunity to get in while investors were keeping their powder dry. Prices softened significantly and rookie buyers jumped in with both feet, taking advantage of financial assistance designed to help with that all important deposit, to avoid Lenders Mortgage Insurance (LMI), and to get their name on the mortgage documents faster.

But more than 12 months on and investors are venturing out of self-isolation and using their lockdown savings to splash out on property.

They’re being lured out by the low-interest environment, which is making for very cheap loans at the moment. This has combined with high rental demand which is pushing rents up and delivering positive gearing opportunities, along with the capital growth thanks to buyers scrambling to secure relatively limited stock across the country.

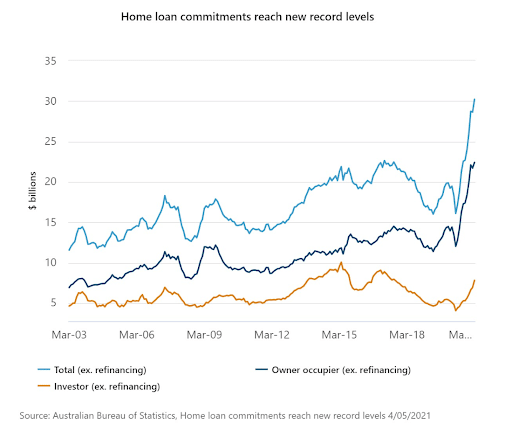

In March 2020, investor lending was at $5 billion, but a year later, it’s increased by almost $3 billion to $7.8 billion, according to the ABS. In April investor loans across Australia increased by 2.1 per cent, reaching a record four-year high of $8.05 billion. Investor lending hasn’t been this high since August 2017, and if current growth trajectory continues it looks set to exceed the all-time high of $10 billion, set in April 2015, within the next 12 months.

First homebuyer flipside

In contrast, ABS data shows first-home buyer loans dropped 1.9 per cent in April, reflecting a demographic being squeezed out by cashed up investors with greater borrowing power.

The data suggests that Queensland’s affordability is luring investors across the border, with loans to investors in the sunshine state growing 7.1 per cent from March to April. Anecdotal evidence from local agents indicates many of these are interstate investors are either re-intvestors or first-time investors looking for an affordable property with good returns. Vacancy rates across Queensland are hovering around 1.0 per cent or below in most markets, giving added incentive for investors to look north.

Speculation among property observers now is that we may finally see a run on apartments in the southeast corner. Markets had been oversupplied to varying degrees for many years, but current conditions are the perfect storm for apartment demand to get a jump start. It will deliver good value as apartments have not had significant price growth over the past five years, which means there are plenty of bargains to be found for savvy first home buyers.

The only sticking point could be stock types. Many of the recently completed inner-city apartments were built as one-bedroom units, which may not suit the owner-occupier market. Since COVID, purchasers are now giving careful consideration to the home office. Where previously ‘study nooks’ passed muster in a one- or two-bedroom unit, now younger office workers are looking to have a comfortable space that will accommodate an extended work-from-home lifestyle.

So, while we may see FHBs finally looking seriously at the apartment market, it’s highly likely that they’ll be looking beyond the small, starter stock that previously would have been a suitable first home. In the right market, they’ll have the buying power to grab a larger two-bedroom or possibly a smaller three-bedroom unit, within reasonable proximity of the CBD.

And this is similar in NSW and Victoria too, first home buyers are simply looking now to what they can afford given the price “explosion”, particularly in Sydney and Melbourne, where middle ring homes and villa units were affordable, these have quickly been pushed out of reach by the plethora of government incentives and cashed up first home buyers and then investors taking advantage of the record low interest rate environment.

Tips for first home buyers competing with investors

There are some ways that a first-home buyer can level the playing field a little and make a seller think twice before jumping up to the investor’s (usually higher) offer.

- Put in a strong deposit: This shows the seller that you are serious. An investor may only put the minimum down, possibly hedging their bets on another property. They want to have the smallest amount at risk if they want to pull out halfway through the deal. A strong deposit shows the seller you are serious and are not a risk of the sale falling over.

- Be flexible on settlement: Many sellers are currently rushing to market because of impressive price growth. If your seller hasn’t yet got all their ducks in a row, it may suit them to stay in the property longer or get out sooner. If you can be flexible on the settlement date that may weigh in your favour. An investor is on the clock and is usually keen to take possession ASAP to do renos and get tenants in quickly.

- Waive the cooling off period or building and pest: This is not something that should be done lightly, particularly setting aside the cooling off period. Only do this if you are 100 per cent certain this is the property for you and you’ve done your due diligence. That said, it indicates to the seller that you are serious and anxious to close the sale. This may be more appealing than another offer from an investor full of contract conditions.

There are ways for first-home buyers to compete with the rising level of investors coming back to the market, but it’s about being smart, rather than trying to outspend.

It’s also about securing good advice around your borrowing and loan-servicing capacity.

The information provided in this article is general in nature and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information you should consider the appropriateness of the information with regard to your objectives, financial situation and needs.

- Choosing the right mortgage solution of variable fixed or both - October 8, 2024

- All You Need to Know About Bank Valuations - September 20, 2024

- Getting the Most out of the Spring Property Season - August 26, 2024