Don’t hold your breath for a rate cut (but we also won’t see any further increases in 2024)

People with vested interests (commentators, journalists and some economists) will always tell you what you want hear – and don’t worry, we have a vested interest to as I’d love for all my clients to paying less in interest but there needs to be a serious balance in reporting here and consideration of all the facts, not just what people want to hear.

We know that many households are battling seriously strained household budgets thanks to 13 rate hikes in a little over 18 months. They’ve now added about $1400 a month on average to home loan repayments. And that pain has come at the same time as a cost-of-living crisis, in which just about everything is more expensive than ever. It’s been a trying time, and so all this talk about the looming start of a downward rates cycle is reason to have a pep in your step, whether you’re paying off a mortgage or looking to buy a home.

At the risk of ruining the party, I’m confident that we actually won’t see a reduction in the cash rate any time soon. Sorry to be the bearer of bad news. Let me explain why.

The RBA needs to be cautious

So, why am I at odds with so many about when we can expect rates to fall?

It’s important to remember just how late the Reserve Bank was to the party when it comes to hiking interest rates to get on top of inflation. One minute, the board was reassuring us that rate rises weren’t something we’ve need to think about for years, and the next they were scrambling to dampen a particularly red-hot CPI reading.

The problem is that while those reassurances were being made, central banks across much of the world were beginning to address inflation. Australia must’ve missed the party invite. It’s a scenario that prompted a government review and inspired a change of leadership.

Rightly so, the RBA copped plenty of flack for how it handled things. Philip Lowe became one of the most derided figures in the country as a result.

You think the RBA Is going to be first to leave the party given all of that?

New governor Michele Bullock and the board will want to make absolutely certain they’ve reined in inflation before they even entertain the idea of cutting the cash rate again. Imagine if they did lower rates, only to need to increase them again soon after? It would be pandemonium.

That’s why I think we can expect a very cautious and conservative approach.

The beast is far from tamed

Whether you own a home or not, we’ve all in some way paid the price for efforts to bash inflation back to a reasonable level. And that level isn’t a mystery either.

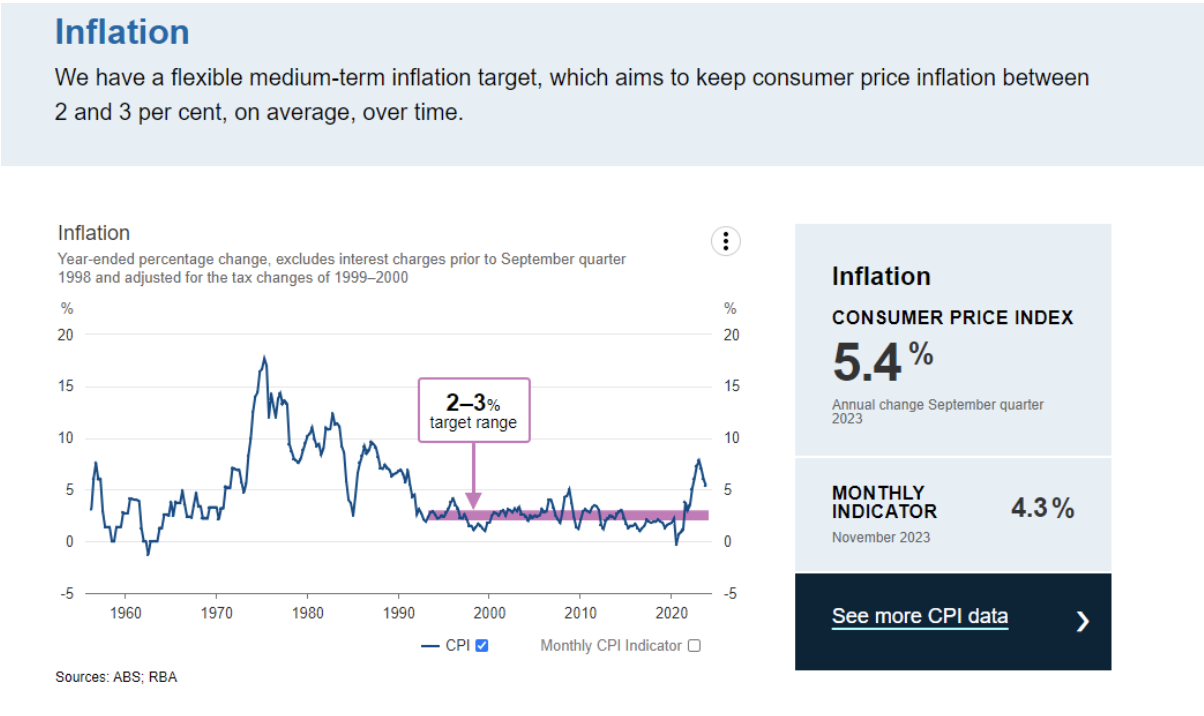

The RBA has a target band for CPI. It wants to see inflation sit within a two to three per cent range in order to feel relatively comfortable about the state of the economy. To put things into perspective, it peaked at 7.8 per cent in early 2023.

Rate hikes have worked in helping to take inflation off the boil and it’s continuing to fall – but it’s reducing at a slower pace than the RBA wanted, and it’s still too high. It’s currently at 5.4 per cent.

We’re some way off being within the RBA’s target and the board is unlikely to react instantly when we are. After all, inflation has proven to be stubborn over the past two years and there’s no guaranteeing it won’t act up again.

I think that we’ll need to get to within the desired band and spend a little time there before the RBA will even consider cutting rates and I doubt this will be in 2024.

There are plenty of variables

Also potentially impacting inflation are global events that risk forcing up prices and disrupting supply chains. There’s the ongoing war in Ukraine. There’s the worsening conflict in Gaza. And now, there’s the crisis in Yemen and assaults on shipping routes in the Red Sea at hands of Houthi rebels.

The Red Sea issue is a big one. For example, Shell has announced it’ll stop using the Red Sea until the danger eases, so expect price consequences as a result. And that’s just one product.

Here at home, there are signs of rising unemployment, which is to be expected during a tighter rates environment. But adding fuel to the fire is the record level of immigration we’ve seen over the past year. Some 500,000 people arrived on our shores in that time, with more expected. The government has cut back on migration levels but even so, the rate will be higher in 2024 and 2025 than it has been for years.

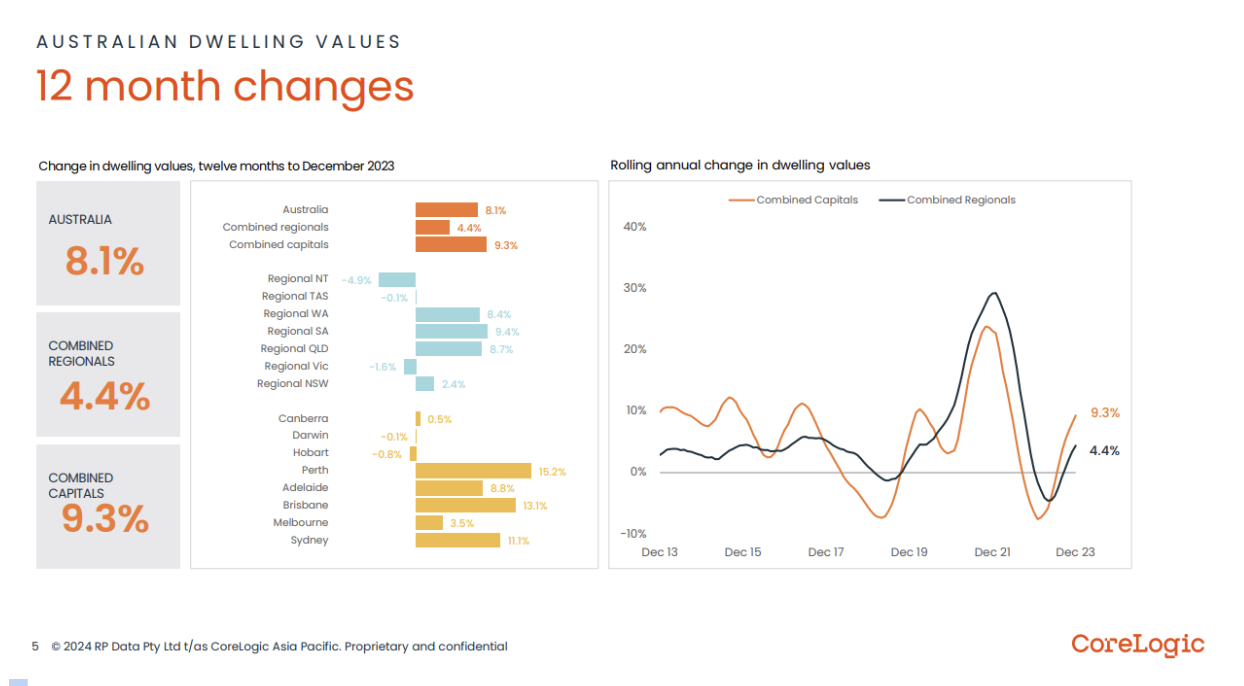

Another major barrier to the RBA’s war against inflation is home prices. They’ve proven extremely resilient, defying all odds to grow strongly in the face of rapidly rising interest rates. The RBA wasn’t expecting that and it’s thrown something of a spanner in the works.

Surely price growth is over for a while, though… right?

So, persistently high demand and incredibly low supply will see upward pressure remain on home prices.

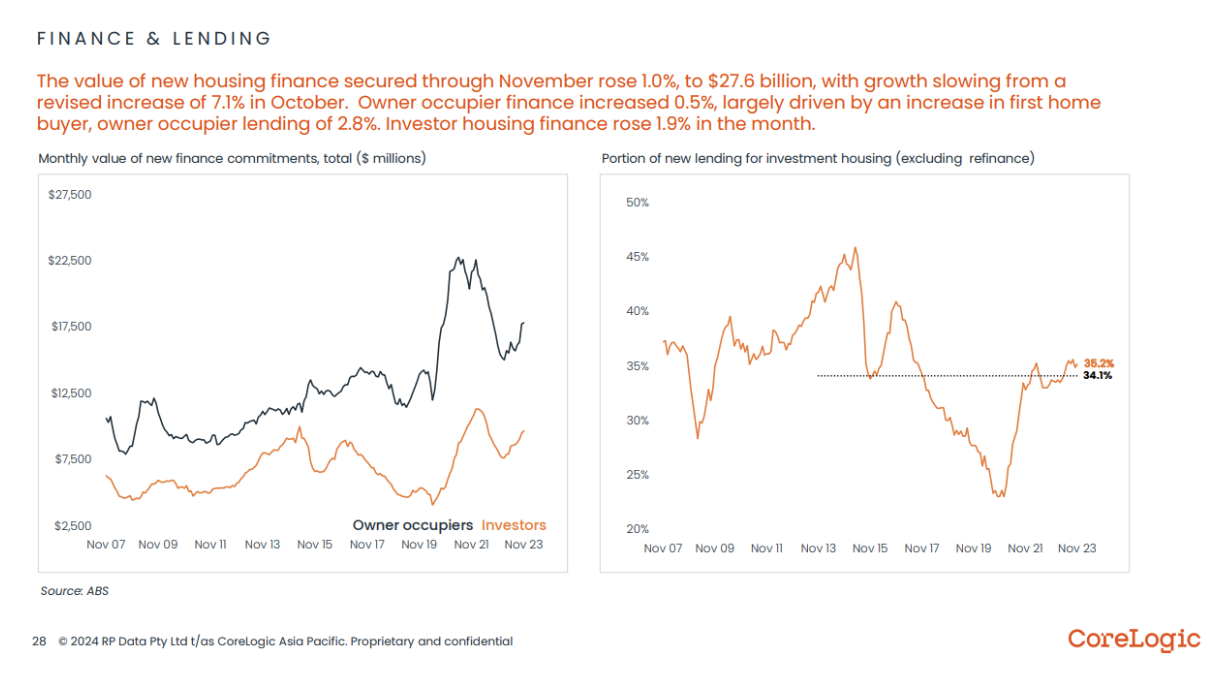

And on the back of our resilient property markets, it seems that people are becoming more adjusted to these higher interest rates as finance applications are now starting to trend back up as can be seen here.

The good news

At the same time, wages growth is finally heading in the right direction, meaning that pay packets will increasingly feel a little heavier. On top of that, those tax cuts will help households a bit.

The government continues to spend on major infrastructure projects, which will support the construction industry, among others, and help to improve our towns and cities, making them more connected and liveable.

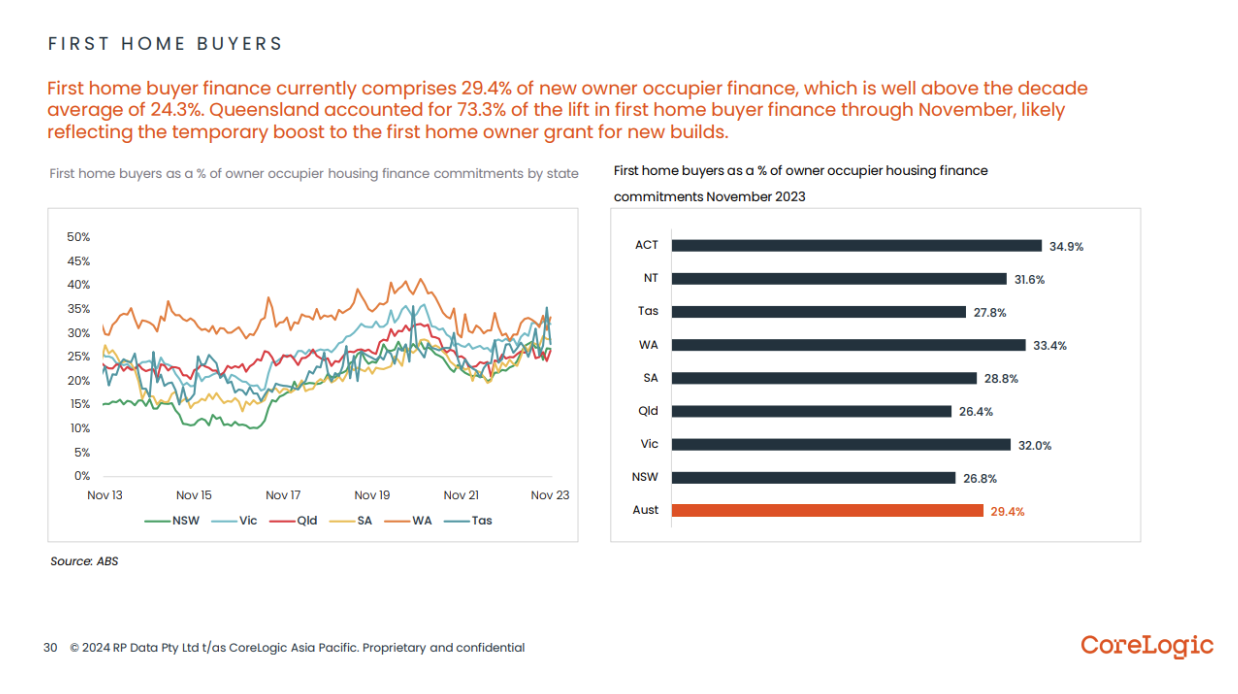

While housing remains a challenge, there are a raft of measures in place – and coming – to help support young Aussies into their first homes.

Of course, all these interacting factors along with the raft of uncertainties can make navigating the borrowing landscape a challenge. The best way to ensure you’re able to secure the best possible outcome from your financial arrangements is to engage a highly qualified and experienced mortgage broker.

Knowledge Hub Updates

- Choosing the right mortgage solution of variable fixed or both - October 8, 2024

- All You Need to Know About Bank Valuations - September 20, 2024

- Getting the Most out of the Spring Property Season - August 26, 2024