This calculator can help to give you a good idea about how much you can borrow.

Want an expert to provide you with a better estimate of your borrowing capacity? Please complete our simple 3 minute evaluation form.

Calculate your borrowing power with our easy tool

It’s an inconvenient truth that buying property for most people is all about how much money a bank will lend you as well as how much you can afford.

Sure, we all have a dream home that we’d love to own, but in reality most of us have to work our way up to buying such a property.

If you’re buying your first home, or even your second or third, it’s always a good idea to have an idea about your borrowing power.

Of course, your borrowing power is how much a bank will lend you.

One way to do that is to use a borrowing calculator that will calculate how much you can borrow.

Be mindful, however, that this will give you a general idea of your borrowing power rather than a definite one, because there are a number of other variables what will also be assessed in your loan application.

How to calculate how much you can borrow

Ok. So you want to understand what your borrowing power is?

Of course, everyone’s circumstances are different, so we’ll need to consider a couple of different types of loan application as examples to give you a rough idea.

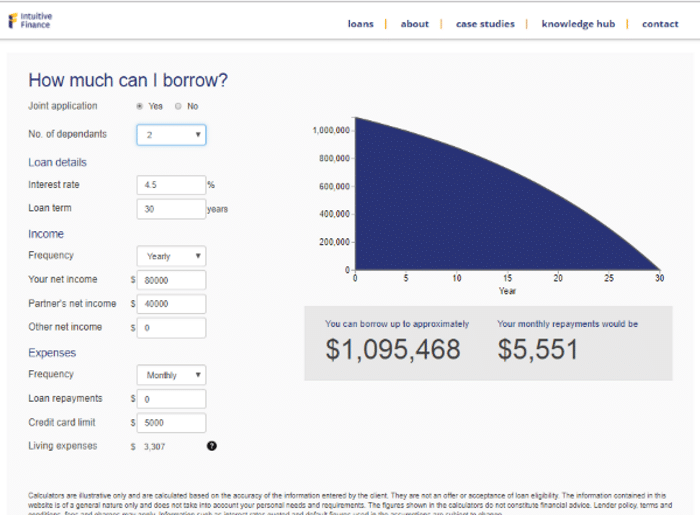

First up, let’s consider a couple with two children, with one parent working full-time and the other part-time. Here’s how to fill in the various boxes:

- Click “yes” it’s a joint application

- Add in “2” in the No. of dependants box

- Add in loan details, which in today’s marketplace could be an interest rate of 4.5 per cent over 30 years.

- Insert yearly net incomes of $80,000 and $40,000

- When it comes to expenses, you need to include any other loan repayments as well as the total limits of your credits cards, which is $5,000 in this example.

- You will see that the borrowing calculator also estimates the monthly living expenses for a family in this instance.

- The result is an estimated borrowing power of about $1.09 million with monthly repayments of $5,551.

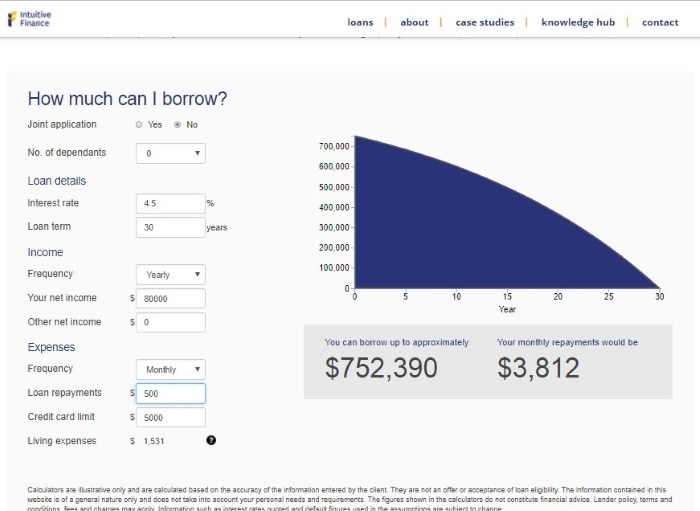

Let’s consider another example, this time for a single person with no children, shall we?

- Click “no” to whether it’s a joint application

- Add in “0” in the No. of dependants box

- Add in loan details, which in today’s marketplace could be an interest rate of 4.5 per cent over 30 years.

- Insert one yearly net income of $80,000

- When it comes to expenses, you need to include any other loan repayments as well as the total limits of your credits cards, which is $5,000 in this example as well as a $500 per month personal loan repayment.

- You will see that the borrowing calculator also estimates the monthly living expenses for a single person.

The result is an estimated borrowing power of about $752,000 with monthly repayments of $3,812.

What other factors influence my ability to borrow?

Borrowing calculators can give you a rough estimate of how much money a bank will lend you but there are a number of other factors that will be considered as well.

When it comes to how much you can borrow, a lender will consider things that might not necessarily translate to a borrowing calculator.

For example, how long you have been at your current job is something that may signal to them whether you have the stability to pay off a loan over 30 years. If you have chopped and changed jobs a lot over recent years, lenders may be more cautious with how much they’re prepared to lend to you.

Another factor that may impact your borrowing capacity is your credit history, which includes missed bill payments as well as the number of loans (of all kinds) that you’ve applied for previously – whether you proceed with them or not. Too many loan applications may signal to a lender that you regularly shop around for loans because you’re not very good at managing your own finances.

Furthermore, your borrowing power can be affected by many other factors such as:

- Your employment type – PAYG income earners vary differently to what a self-employed person in terms of what they earn, and also what they can “add back” to improve their capacity

- Interest-only terms and length of them

- Principal & interest vs interest-only loans

- Borrowing for a home versus borrowing for an investment property are different. For a home it’s simply your income and then your ability to meet the home loan repayments, whereas for an investment property purchase you also have rent to include, and the negative gearing benefits that further assist your capacity

Wow, there is a bit to consider isn’t there?

What if my financing needs are more sophisticated than this?

Everyone’s investment finance needs are different, especially depending on whether you are a first-time or a sophisticated investor.

Sophisticated investors may already be the owners of multiple properties, but perhaps they haven’t had the best financial advice and guidance along their journey.

Some financial issues they could face when it comes to their borrowing power is that some or of all of their portfolio could be cross-collaterised, which reduces flexibility as well as increases the difficulty if they wanted to sell any of the properties.

Who should I talk to for advice on borrowing and home investment?

Understanding your borrowing capacity is one of the first steps on the path to home loan success.

And using a borrowing calculator to help you determine what you can afford is a good place to start.

The world of banking and finance can be a pretty daunting one for both novice and sophisticated investors and since our establishment in 2002 we’ve focused on providing outstanding service and business standards.

This approach was vindicated when we were named Victoria’s favourite mortgage broker at the Investors Choice Awards.

So, if want the most suitable loan guidance for investors and homeowners, why not contact Intuitive Finance today to ensure you have the right information and expert support on your side from the very beginning?

And if you’d like an expert to provide you with a better estimate of your borrowing capacity please complete our simple three-minute evaluation form.