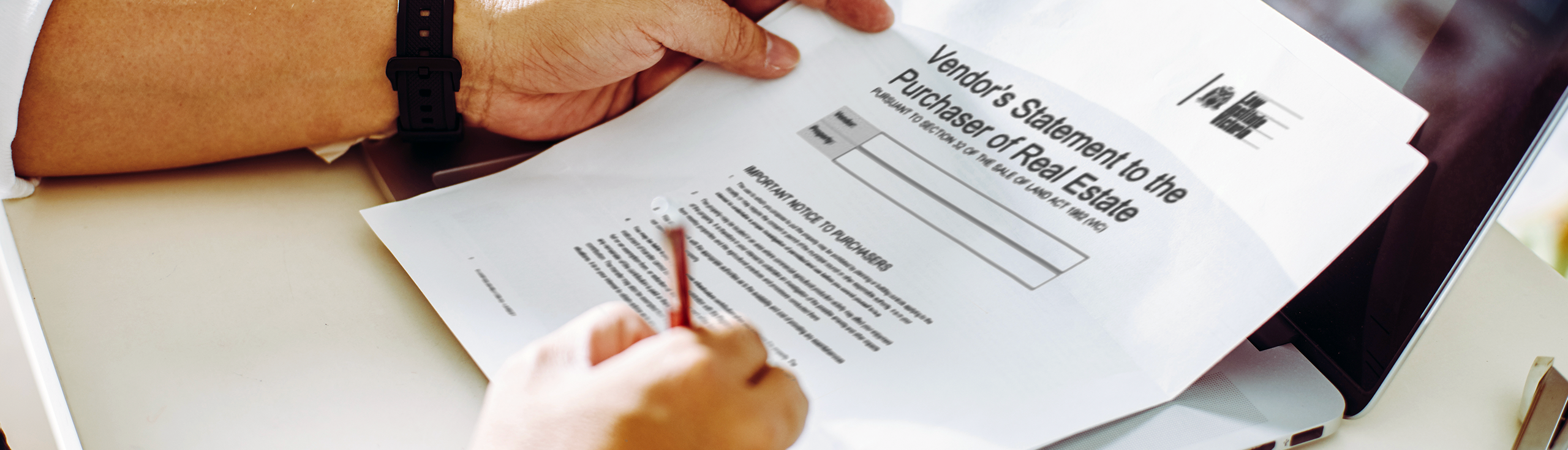

What to look for in the contract of sale – state by state

Buying real estate is a major step that involves the legal transfer of property from one person to another.

That transaction is managed by a Contract of Sale, which can differ in some ways from state to state in Au…