High Reliance on Two Incomes to Repay Home Loans Presents a Potential Risk

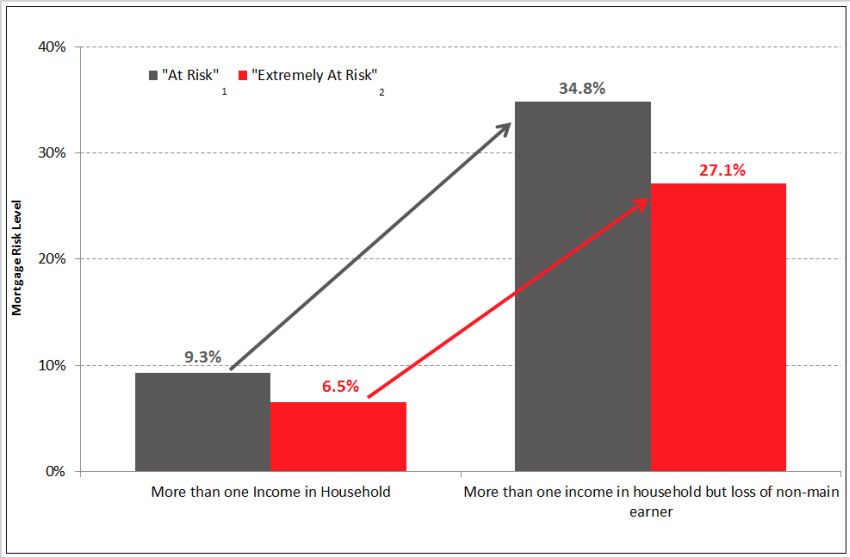

More than two-thirds (67.2%) of owner-occupied mortgages are now held by households with two incomes, presenting some problems if one decides to either drop out of the workforce or becomes unemployed.

Overall some 9.3% of dual-income households are classified as ‘at risk’ of mortgage stress but if even the non-main earner drops out of the workforce, Roy Morgan estimates some 34.8% will be at risk of mortgage stress.

These are some of the findings from the latest Roy Morgan ‘State of the Nation-Spotlight on Finance Risk’ report.

The data is from Roy Morgan’s Single Source survey of more than 500,000 interviews over the last decade.

Over 700,000 Australians with a home loan potentially ‘at risk’

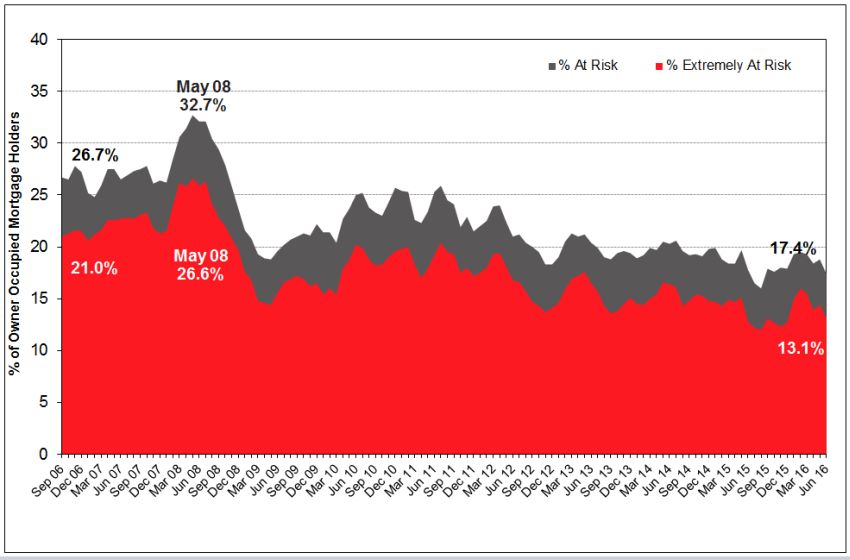

Currently 17.4% of Australians (705,000) who have a mortgage on the home they are living in can be classified as being ‘at risk’, based on an average interest rate of 5.4%.

Mortgage stress (‘at risk’) is based on the ability of borrowers to meet the repayment guidelines currently provided by the major banks and is based on the amount originally borrowed.

Over the last 10 years, mortgage holders ‘at risk’ peaked in May 2008 (32.7%) when the standard variable home-loan rate was 9.45%.

Mortgage stress: owner-occupied

Source: Roy Morgan Research: 3 month moving average (n=2,400). Base: Australian population aged 14+ who have a mortgage on the home they are living in

The August rate reduction to 5.25% is likely to reduce mortgage stress marginally but this will ultimately depend on how borrowers react to it, particularly in relation to whether the drop in interest rate encourages increased borrowings.

An additional measure of mortgage stress is based on those borrowers paying more than the repayment guidelines on the amount currently outstanding.

These people are classified as being ‘extremely at risk’ and account for 13.1% of mortgage holders (520,000).

This is actually a historically favourable level, and is likely to decline a little further when the full impact of the August interest rate drop is felt.

The proportion of ‘extremely at risk’ mortgage holders peaked in May 2008, when the interest rate was 9.45%.

Two-thirds of mortgage holders are in two-income households

There are 3.2 million mortgage holders (67.2% of the total) who are in dual-income households and as a result have lower-than-average mortgage risk levels, with only 9.3% being ‘at risk’ and 6.5% ‘extremely at risk’.

Both of these levels are well below the overall market average risk levels of 17.4% and 13.1% respectively.

Impact on Mortgage Stress of Loss of Non-main Earner

Base: Has an owner-occupied dwelling with mortgage and more than one income in household, 3 months to June 2016 (n=1,659). 1. Based on amount borrowed. 2. Based on amount owing.

Two-income households have a much lower mortgage risk level providing they can retain both incomes.

Risk levels increase dramatically if one income in these households is lost due to having a family, unemployment, retirement or any other reason.

The loss of even the non-main income earner for instance will drive the ‘at risk’ level up from 9.3% to 34.8% and the ‘extremely at risk’ from 6.5% to 27.1%.

Both of these are approximately double the level of the average mortgage holder.

With such a heavy reliance on two incomes, the impact of losing an income is greater than a doubling of interest rates.

Norman Morris, Industry Communications Director, Roy Morgan Research says:

“Although mortgage stress levels have tended to decline over the last five years in line with the drop in interest rates, they remain of some concern with 17.4% of mortgage holders ‘at risk’ and 13.1% ‘extremely at risk’.

“Although mortgage stress levels have tended to decline over the last five years in line with the drop in interest rates, they remain of some concern with 17.4% of mortgage holders ‘at risk’ and 13.1% ‘extremely at risk’.

Mortgage stress levels are likely to remain high even with further interest rate reductions, as this appears to encourage higher house prices and borrowings.

“The heavy reliance on two-income households for home-loan repayments reduces mortgage risk providing both parties remain employed.

The biggest impact on mortgage stress is likely to be unemployment or a move to increased levels of underemployment.

This analysis has shown that the loss of an income in a two income-household has more impact than a doubling of interest rates.

“We have seen in our research that home ownership levels are likely to decline further while prices continue to outpace growth in household incomes and as a result borrowers are likely to be stretched further in their ability to make loan repayments.

“With increased mortgage debt comes the increased likelihood that when people retire they will do so with some debt, which will obviously impact on retirement funding.

Our analysis shows that mortgage risk is in fact higher already higher for the over-60s due to lower average incomes.

“This release is drawn from the extensive Roy Morgan Single Source survey of over 50,000 people pa and covers only a small part of what is available.

Over the last 12 months alone we have interviewed more than ten thousand owner-occupied mortgage holders, enabling an in-depth understanding of their full financial position.

This unique database provides detailed insights for anyone involved or interested in this key segment of the Australian population.”

- 8 Charts explaining why we’re in for a great time in property in 2021 - January 5, 2021

- New data shows COVID-19’s impact on Australians’ personal finances, including debt and insurance - December 21, 2020

- 4 key reasons why the property pessimists are changing their minds - October 12, 2020