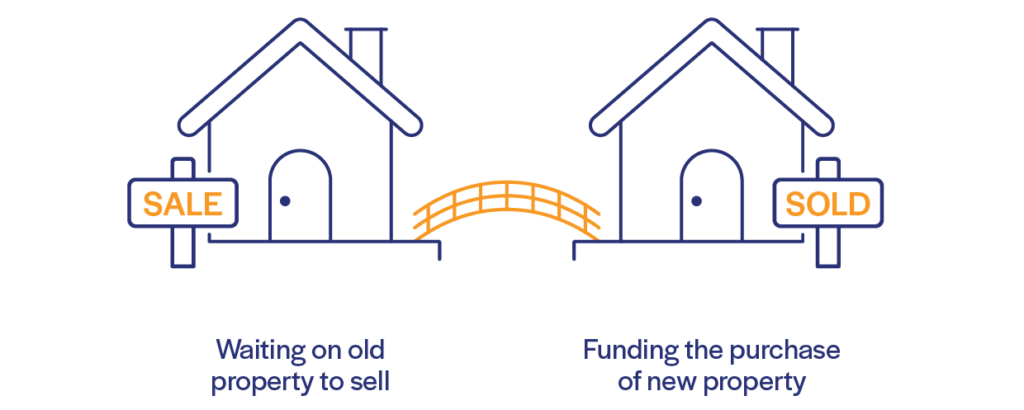

Bridging loans provide a short-term financing solution that allows you to purchase a new property before selling your existing one. At Intuitive Finance, we offer expert guidance to help you navigate the complexities of bridging loans, ensuring you secure the best option for your financial needs.

What are Bridging Loans?

A bridging loan is a short-term loan that helps you finance the purchase of a new property while you wait for your existing property to sell. This type of loan covers the gap between buying your new home and selling your old one, ensuring a smooth transition without the need for immediate sale. Bridging loans provide the necessary funds to secure your new property, offering peace of mind and financial flexibility during the process.

Types of Bridging Loans

Closed Bridging Loan

A closed bridging loan is available to borrowers who have already exchanged contracts on the sale of their existing property but have not yet completed the sale. This type of loan has a fixed end date, providing certainty about when the loan will be repaid.

ADVANTAGES

- Flexibility: Allows you to buy a new property before selling your current one.

- Short-Term Solution: Provides temporary financing to bridge the gap between transactions.

- Peace of Mind: Ensures a smooth transition without the pressure of immediate sale.

Open Bridging Loan

An open bridging loan is suitable for borrowers who have found a new property but have not yet sold their existing one. This type of loan does not have a fixed end date, offering more flexibility but typically comes with higher interest rates due to the increased risk.

DISADVANTAGES

- Higher Interest Rates: Typically comes with higher interest rates compared to standard home loans.

- Increased Risk: Financial risk if your existing property takes longer to sell than expected.

- Additional Costs: May include additional fees and charges.

What’s Involved in Obtaining a Commercial Loan Through Intuitive Finance?

Initial Meeting

A 1-hour session to establish your financial and lifestyle goals, discuss the fact-finding document, and agree on a timeline for its return.

Fact Finding Submission

We will submit the completed fact-finding document.

Strategy Submission

Within 5 days of receiving the completed fact-finding, a written strategy is submitted to you.

Document Lodgement

Within 2 days of agreeing to proceed, documents are lodged with the institution.

Conditional Approval

Expect conditional approval within 1 to 3 days of lodgement.

Unconditional Approval

Expect unconditional (full) approval within 2 to 4 days after conditional approval.

Loan Documents Arrival

Expect loan documents to arrive within 2 to 5 days after unconditional approval.

Loan Settlement

Expect loan settlement within 3 to 5 days after submitting the signed loan documents.

Complimentary Obligation-Free Consultation

Discuss your specific needs and discover the best financing options for you. Get in touch to

organise your complimentary 60-minute session today!

Property Buyer Loan Calculators

Real Feedback from Real Clients

Our Commitment to the Community

With every loan we settle, you can choose to support Challenge – supporting

kids with cancer, the Movember Foundation, or the Lungitude Foundation.

We donate $20 to your chosen charity and make annual contributions. It’s our

way of giving back and helping those in need.