This is a handy calculator to help you calculate the fees and charges involved with the purchase of a property.

For more exact expert advice please contact us

Calculate Stamp Duty and Transfer Fees with Our Easy Tool

We all know how hard it can be to save the initial deposit for your home or investment property, but it does get easier once you have the first one (or two) assets under your belt.

It’s important that you also consider how much the other fees and charges will be to complete the investment transaction, because you don’t want to be caught short during the finance period.

Thankfully we have our handy home loan fee calculator that you can use to work out how much stamp duty and transfer fees will be in your next property purchase.

How to calculate home loan fees

Before we go any further, you need to understand that fees such as stamp duty can vary widely across the country because there are differing rates set by each State or Territory Government.

Stamp duty can also vary depending on whether the purchase is an investment or an owner-occupied home such as in Queensland or if you’re a first home buyer.

In this example, however, we will show you how to calculate stamp duty as well as other fees in Victoria to keep it nice and simple.

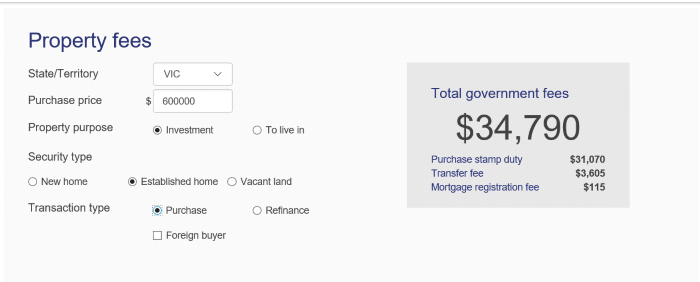

Let’s say Rod and Sarah are considering buying an established investment property with a value of $600,000. They have a deposit of $120,000 courtesy of existing equity in their home as well as some savings, here is how they would calculate their home loan fees:

- Change the State/Territory to Victoria.

- Input the purchase price of $600,000.

- Change the property purchase button to Investment.

- Then indicate that the property is an established one.

- Change the transaction type to purchase.

As you can see, in this example, Rod and Sarah would be liable for stamp duty of about $31,070 as well as a transfer fee of $3,605 and a mortgage registration fee of $115.

Therefore the total additional home loan fees to complete the transaction would be about $34,790.

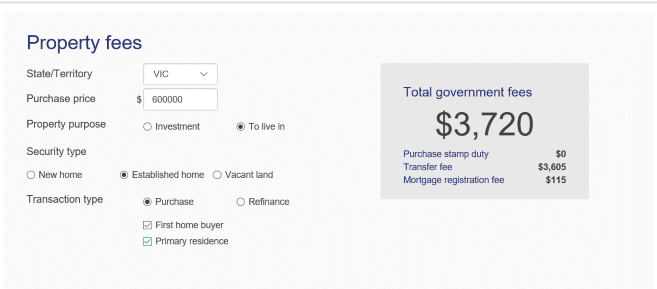

Now let’s consider another example, this time Glenn and Nicole who are first home buyers. They have saved hard to buy their first home and decide on an established home in Victoria.

- The key difference in this example is that under transaction type, they tick first home buyer and primary residence.

As you can see the difference in stamp duty payable is vast because of State Government first home owner concessions.

So, for Glenn and Nicole, their additional fees for their home loan will be $3,720, which consists of $3,605 for the transfer fee and $115 for the mortgage registration – but zero for stamp duty!

How do these calculations differ in each state?

As we mentioned earlier, home loan fees differ in each State because of varying rates of stamp duty as well as state-specific first home buyer grants and concessions, which can change from time to time.

With more investors looking outside their home state or territory to invest because of market conditions or affordability considerations elsewhere, it’s important that they calculate the home loan fees in the location of their potential investment property.

Let’s take a look at an investor who is considering buying in New South Wales versus one who is looking at Queensland.

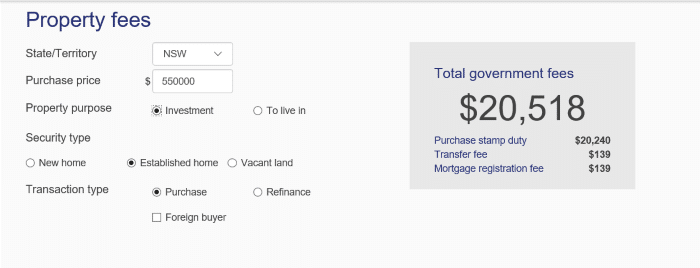

Joe lives in Melbourne but is considering investing in Newcastle in NSW. His budget is around $550,000. Here is how he would calculate the home loan fees in that State:

- Change the State/Territory to NSW.

- Input the purchase price of $550,000.

- Change the property purchase button to Investment.

- Then indicate that the property is an established one.

- Change the transaction type to purchase.

To buy an investment property in Newcastle, Joe would be need an extra $20,518 to complete the transaction with $20,240 being the stamp duty liability.

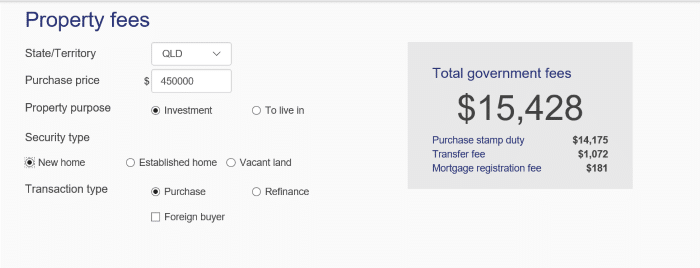

Margaret and John, on the other hand, are considering buying a new property in Queensland for $450,000 given property prices are generally lower in that State. To calculate their home loan fees in that State they would:

- Change the State/Territory to QLD.

- Input the purchase price of $450,000.

- Change the property purchase button to Investment.

- Then indicate that the property is a new home.

- Change the transaction type to purchase.

For Margaret and John, their home loan fees would be $15,428, of which $14,175 is stamp duty.

The difference between the two home loan fees is because of varying duty rates as well as the lower purchase price in Queensland.

It’s also important that you understand if security or transaction types would affect your home loan fees.

Where can I find out more about home loans, stamp duty and transfer fees?

Buying your first property or investment doesn’t have to be difficult.

And when it comes to understanding home loans, stamp duty and transfer fees there is plenty of help out there.

The world of banking and finance can be a pretty daunting one for both novice and sophisticated investors and since our establishment in 2002 we’ve focused on providing outstanding service and business standards.

This approach was vindicated when we were named Victoria’s favourite mortgage broker at the Investors Choice Awards.

So, if you want the best loan advice for investors and homeowners, why not contact Intuitive Finance today to ensure you have the right information and expert support on your side from the very beginning?

If you’d like an expert to provide you with a better understanding on home loan fees or if you have any other questions, please just contact us directly and we’ll be in touch.