Guarantor home loans provide an opportunity to purchase a property with the assistance of a guarantor, often a family member, who uses their own property as security. At Intuitive Finance, we offer expert guidance to help you navigate the complexities of guarantor home loans, ensuring you secure the best option for your financial needs.

What are Guarantor Home Loans?

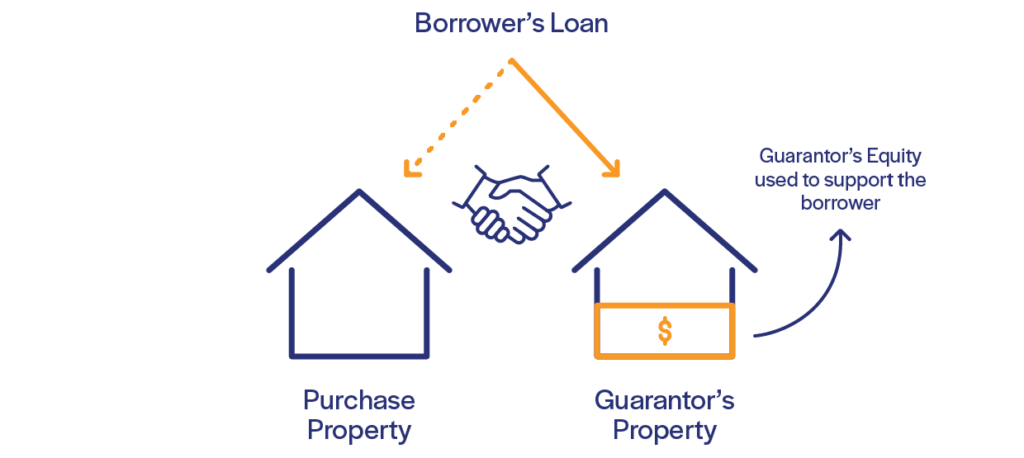

A guarantor home loan allows you to borrow a higher percentage of the property value or even the full purchase price, using the equity in your guarantor’s property as additional security. This can be a great option for first-time buyers or those who have limited savings for a deposit. The guarantor’s property acts as a safety net, reducing the lender’s risk and potentially allowing you to avoid paying Lenders Mortgage Insurance (LMI).

When considering a guarantor home loan, it’s important to understand the key issues.

- Guarantor’s Liability: The guarantor’s property is at risk if you default on the loan.

- Future Financial Plans: The guarantor may have limited borrowing capacity for their own needs while the guarantee is in place.

- Loan Structure: Deciding whether to secure the entire loan or just a portion with the guarantor’s property.

Types of Guarantor Home Loans

Family Guarantee Loan

A family guarantee loan involves a family member using the equity in their property as security for your loan. This type of loan can help you secure a higher loan amount or avoid LMI without requiring a large deposit.

Limited Guarantee Loan

A limited guarantee loan allows the guarantor to limit their exposure to a specific amount or portion of the loan. This provides more flexibility and reduces the risk for the guarantor while still helping you secure the necessary financing.

ADVANTAGES

- Higher Borrowing Capacity: Borrow a larger amount or the full purchase price with a smaller deposit.

- Avoid LMI: Potentially avoid paying Lenders Mortgage Insurance.

- Family Support: Benefit from the financial support of a guarantor.

DISADVANTAGES

- Guarantor’s Risk: The guarantor’s property is at risk if you default on the loan.

- Complex Arrangements: Requires clear agreements and understanding between you and the guarantor.

- Impact on Guarantor: Limits the guarantor’s borrowing capacity and financial flexibility.

Frequently asked questions

What’s Involved in Obtaining a Commercial Loan Through Intuitive Finance?

Initial Meeting

A 1-hour session to establish your financial and lifestyle goals, discuss the fact-finding document, and agree on a timeline for its return.

Fact Finding Submission

We will submit the completed fact-finding document.

Strategy Submission

Within 5 days of receiving the completed fact-finding, a written strategy is submitted to you.

Document Lodgement

Within 2 days of agreeing to proceed, documents are lodged with the institution.

Conditional Approval

Expect conditional approval within 1 to 3 days of lodgement.

Unconditional Approval

Expect unconditional (full) approval within 2 to 4 days after conditional approval.

Loan Documents Arrival

Expect loan documents to arrive within 2 to 5 days after unconditional approval.

Loan Settlement

Expect loan settlement within 3 to 5 days after submitting the signed loan documents.

Complimentary Obligation-Free Consultation

Discuss your specific needs and discover the best financing options for you. Get in touch to

organise your complimentary 60-minute session today!

Property Buyer Loan Calculators

Real Feedback from Real Clients

Our Commitment to the Community

With every loan we settle, you can choose to support Challenge – supporting

kids with cancer, the Movember Foundation, or the Lungitude Foundation.

We donate $20 to your chosen charity and make annual contributions. It’s our

way of giving back and helping those in need.