4 key reasons why the property pessimists are changing their minds

Why were all those property pessimists wrong?

In fact, why are they becoming more positive about property?

Of course it wasn’t just the usual band of Negative Nellies making dire predictions of significant property price falls earlier this year, it was also some credible economists suggesting property values could fall by up to 20%.

Yet despite Australia being in recession, unemployment rising and many small businesses struggling, property value declines have been fairly mild and it’s becoming increasingly clear that, other than Melbourne, this modest coronavirus induced housing correction may be coming to an end.

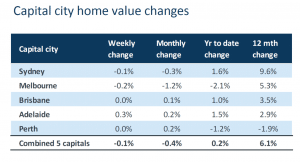

In fact, the CoreLogic indices clearly show that house prices are gradually stabilising or starting to slowly climb again in Sydney, Canberra, Adelaide, Brisbane and Perth.

So let’s look at four reasons why house prices haven’t plummeted.

-

House prices rise quickly but slide slowly.

Property markets are less volatile that the share market.

Property researcher John Lindeman explains that during booms, property values tend to rise quickly because properties are snapped up as soon as they come on the market.

During the good times, the number of properties listed for sale are outnumbered by large numbers of bidders who compete with each other to purchase, and as long as buyer demand remains high, a boom results.

However, when buyer demand falls potential sellers dig in their heels and begin a waiting game, hoping that a buyer will turn up.

The first signs of a slowdown in buyer activity are therefore not declines in sale prices, but a growth in the number of properties listed for sale and an increase in the time it takes to sell them as we’re currently experiencing.

However, when most discretionary sellers find it difficult to sell their properties rather dropping their asking price many take their properties off the market and wait until things improve.

-

There are very few forced sellers at the moment.

Interest rates are at historic lows making it easier for most Australians to keep up their mortgage payments, but those homeowners and investors who are struggling financially due to COVID-19 have been given a lifeline over the last few months and have been able to defer their loan repayments.

In fact, more than 800,000 people have deferred repayments during the coronavirus pandemic leading to concerns about an “economic cliff” in September when the original loan deferral period was meant to end.

Well that didn’t happen as many borrowers were given a further four months to start paying back their loans, but the latest figures from the Australian Prudential Regulation Authority show the volume of loan deferrals fell slightly in July 2020, as more borrowers started to make repayments on their deferred loans.

And don’t worry about the banks withdrawing their support any time soon.

Think about it… they don’t want to take over your home as mortgagee in position. They’re keen to help their customers through these challenging times.

It’s obviously not in anyone’s interest to see a large number of mortgagee sales and house prices tumbling.

-

Renters are being hit harder than homeowners.

Unemployment around Australia is high and is likely to continue to increase and those hit the hardest tend to be younger people.

This rise in unemployment amongst young people, many of whom work in hospitality, the arts and tourism, has hurt the rental markets more than the housing market, with the inner-city Sydney and Melbourne apartment market being the hardest hit.

Similarly, our rental markets are also particularly susceptible to declines in overseas migration, because the majority of new migrants seek rental housing upon arrival in Australia.

-

We’re not all in the same boat.

Not everybody in Australia is struggling. We may be in the same ocean, but we’re not in the same boat.

Sure unemployment is high but over 80% of Australians still have a secure job.

And despite the recession we’re working our way through, some parts of our economy are doing well, while others are being supported by record levels of government stimulus including JobKeeper and Home Builder.

But there’s no doubt that the economic shock has made most of us more nervous and more Australians are stashing their cash with households currently saving nearly 20% of their disposable income, compared to 6% in the first quarter of 2020.

So what’s ahead?

Fact is…there are too many vested interests in our property markets to allow them to collapse.

Our banking sector is underpinned by residential real estate loans, so the banks are not going to pull out the rug from under their customers.

At the same time the government understands the importance of consumer confidence in hauling us out of this recession and into recovery.

They also recognise that a recovery in our real estate markets will be enormously helpful as the wealth effect of rising house prices increases confidence and consumer spending.

At the same time, there is pent-up demand from both home buyers and sellers, who are just waiting for someone to ring a bell and tell us it’s all over, meaning as confidence gradually returns our property market will rebound.

This will be helped by historically low interest rates and the various government stimulus packages to revive our economy.

We are likely to seem even more incentives to encourage homebuyers and home building, as the government recognises the economic flow on affect when people move home.

Then in the medium-term, the government will open our borders and stimulate immigration recognising that more people in our country will mean more spending leading to an increase in our GDP and more taxes to fund the various programs including all their infrastructure spending.

There’s no doubt our economy and our property markets face significant headwinds but there is no imminent collapse of property prices.

- 8 Charts explaining why we’re in for a great time in property in 2021 - January 5, 2021

- New data shows COVID-19’s impact on Australians’ personal finances, including debt and insurance - December 21, 2020

- 4 key reasons why the property pessimists are changing their minds - October 12, 2020