What is the world’s most expensive property market? You need to read this!!

What is the world’s most expensive property market?

Some of you may have guessed Sydney.

And to be fair you are close.

Sydney is the 2nd most expensive housing market in the world.

However, the clear leader (by far) and the least affordable housing market in the world is…

Hong Kong.

I wanted to write this blog to put things in perspective.

You see… being a Sydneysider, I have a soft spot for the city.

No doubt the cost of living is high and housing affordability is simply becoming, well… unaffordable for some.

Especially in the affluent pockets of Sydney.

But is it really that bad?

To answer that question… let’s take a closer look at THE most expensive property market in the world, Hong Kong.

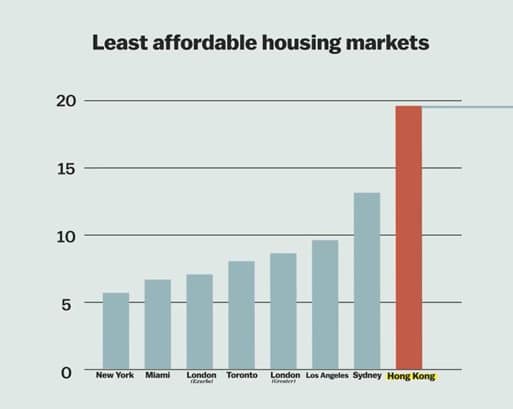

According to Demographia 2018, Hong Kong house prices are 19.7 times higher than the median household income.

Yes you read that correctly… 19.7 times.

That means that the average household earning $50,000 per year would be purchasing a home worth $985,000.

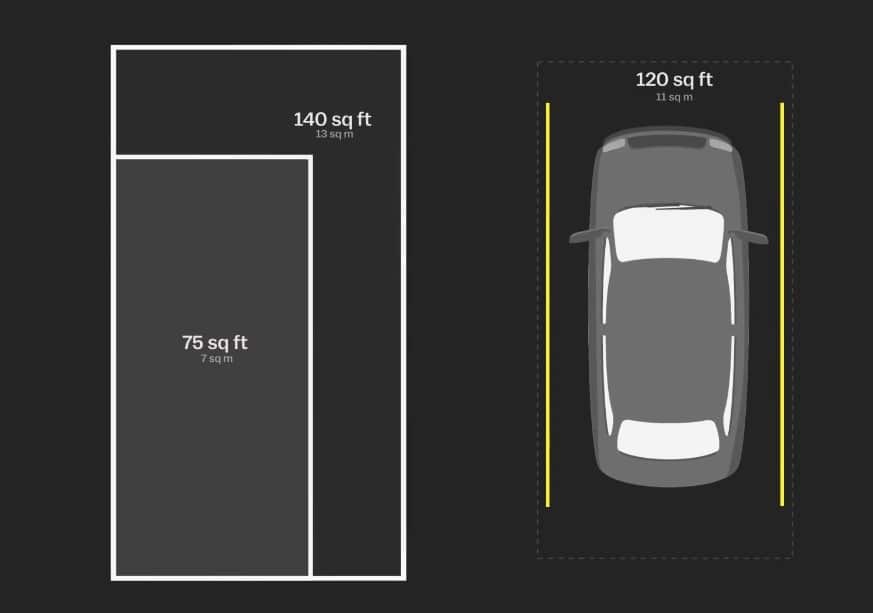

As a result, and in order to survive, there are now 10’s of thousands of people in Hong Kong that live in spaces that are no more than 7sqm – 13sqm.

To put things in perspective, the average parking space is 11sqm.

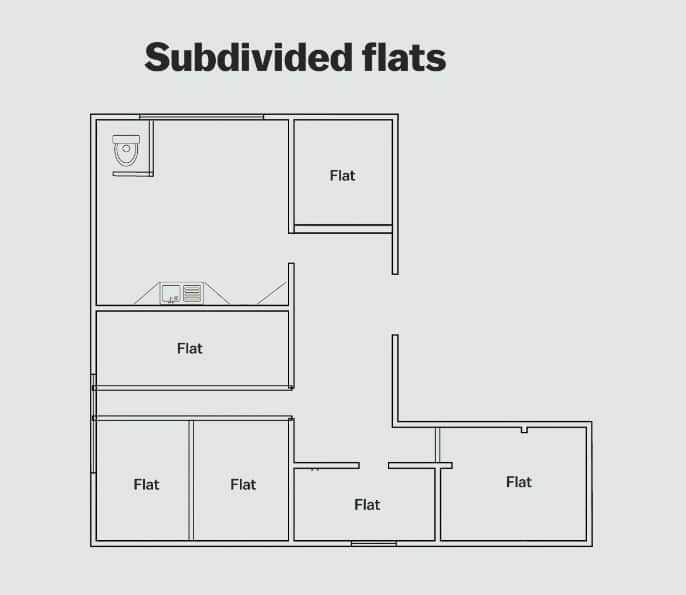

One solution to battle this issue has been to subdivide flats into tiny living spaces.

Imagine a 50 sqm flat divided into 6 tiny living spaces.

In each living space or flat you could have up to 2-3 individuals in a space that accommodates nothing more than perhaps a bed and small table.

That means in an extreme case you could have up to 18 individuals living in a small 1 or 2 bedroom flat.

Think about that for a second.

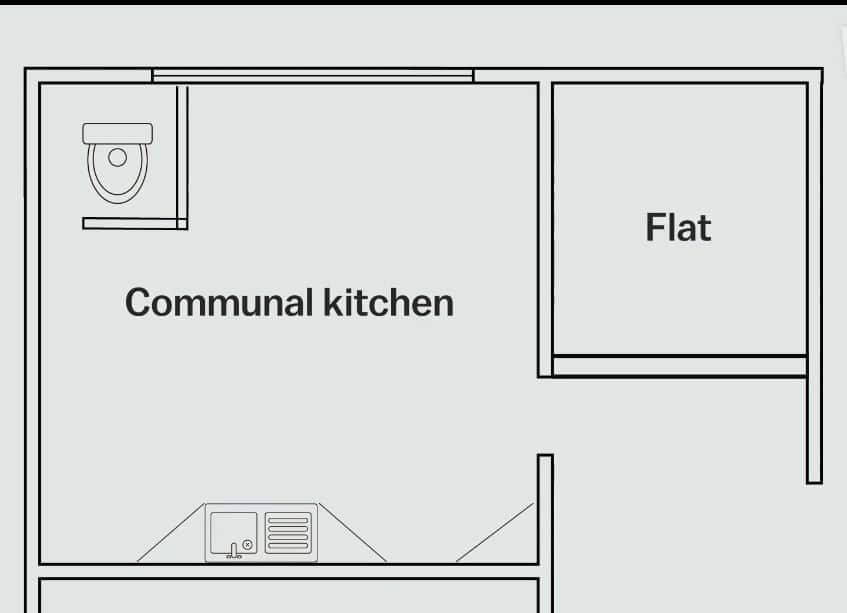

According to the residents of these subdivided flats, what makes the space work is that they have a large communal space with cooking, washing and bathroom facilities that is open to everyone.

So why are the prices so high?

Is it land scarcity?

Is it simply supply and demand? With the libra scale tipping towards demand.

Is it because there are 7.5 million people crammed into a series of islands and that is bound to drive up prices?

Well there is a similar story with a number of cities that have run out of space and have high demand e.g. San Francisco or New York City.

However on closer investigation

Although Hong Kong has a dense urban landscape there is also a lot of green space.

Although Hong Kong has a dense urban landscape there is also a lot of green space.

In fact, 75.6% of the land in Hong Kong is not developed.

Now some of that is mountainous, rocky and difficult to build on but certainly not all of it.

Which makes you think, is it actually land scarcity that’s causing the high prices?

No it’s not.

The reason for the high prices is actually… bad land management.

What does that mean?

Well, for example, of all land in Hong Kong, only 3.7% is zoned for high density urban housing.

And that’s not because of mountains, it’s because of policy.

And this is where we start to scratch the surface.

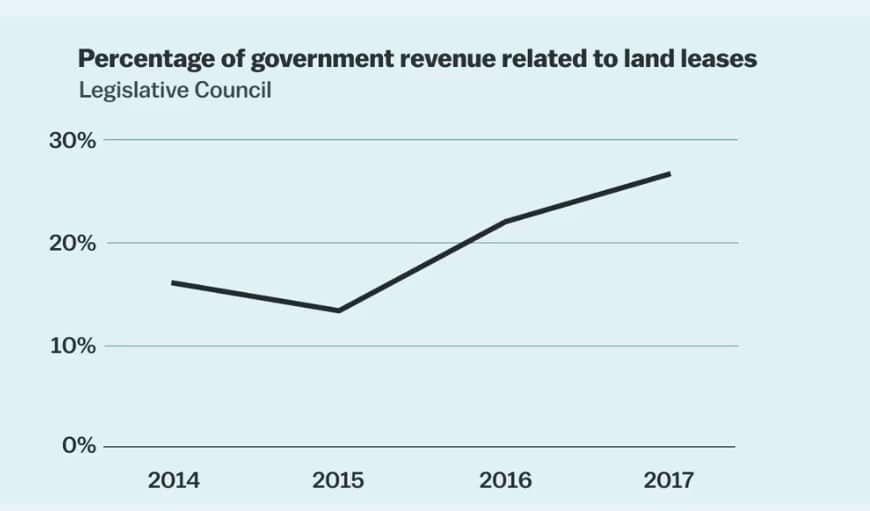

You see, the government owns almost all of the land in Hong Kong.

They then lease it out to developers for a period 50 years in an auction process, where the highest bidder gets the contract.

As you can imagine, these bids end up at an astronomically high price.

A single plot of land can be leased out for billions.

Take the image below for example, this piece of land was leased out to a developer for $2.2.

This shed an all-time record for the most expensive piece of land ever leased by the Hong Kong government.

So the way the government zones and leases land is the first part of this.

The other part of this explanation has much to do with taxes.

I hope I haven’t lost you

I know most people go cross eyed when they hear the word taxes so bear with me.

Hong Kong is notorious for having low taxes and in some cases no taxes.

That’s what makes it a great place to do business.

However, it also means the government is not getting much revenue from taxes.

And accordingly, must get that revenue from another source.

And that source is land sales.

This means the government doesn’t have an incentive to free up land at lower prices.

And yes, the current arrangement of leasing out land is good for revenue to the government, and for the economy and market in general.

But, it’s not so good for the people of Hong Kong.

Now the government is slowly working on the problem and each year new policies are introduced to fix the situation.

However, the fix is slow as there is incentive to keep the status quo as is.

So, what’s the solution

Well where there are problems, you will find entrepreneurs getting creative to find a solution.

Subdivided flats is one… another comes in the form of living capsules.

The capsules come in 1 or 2 person sizes and are meant to provide a more efficient and hygienic version of some of the housing that many are forced to live in.

All at a relatively low price.

- 8 Charts explaining why we’re in for a great time in property in 2021 - January 5, 2021

- New data shows COVID-19’s impact on Australians’ personal finances, including debt and insurance - December 21, 2020

- 4 key reasons why the property pessimists are changing their minds - October 12, 2020