10 Common mistakes investors make during a property downturn

2019 is shaping up to be an interesting year with the value of many properties still falling.

While this is the eighth property downturn I’ve experienced in my 40+ years of investing, and I saw it coming and I’m taking advantage of it; the current market is causing concern and stress for many investors who’ve never invested in a downturn.

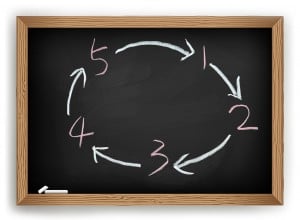

In reality the market is just doing what it always does — moving in cycles, meaning once this decline is over it will continue to do what it always does, and the value of well-located properties will keep increasing.

Remember the market doesn’t care!

It is unemotional. The problem is people care and at this stage of the cycle emotions creep in causing some investors to make poor decisions.

You see… just like the market moves in cycles, so do investors’ emotions — from fear to greed to fear to greed.

In general, the Australian property market is driven by owner occupiers who make up around 70% of all transactions.

However, property booms are driven by investors and their F.O.M.O (Fear Of Missing Out).

Similarly, property downturns are intensified by investor fear just like now when many are staying out of the market driven by F.O.B.E. (Fear of Buying Early.)

And if history repeats itself, and it most likely will, here are ten common mistakes many investors will make because of their emotions:

1. Not really understanding the nature of the property cycle

Many beginning investors don’t realise that in every property cycle there will be as many years of flat or falling property values as there will be years of rising values.

In time they’ll learn that, at least in our capital cities, all market declines are temporary while the long-term increase in property values is permanent.

2. Not adhering to their property strategy

When tempted to jump ship and sell up, investors should focus on why they initially invested in property, rather than worrying about the temporary declines or the unpredictability of the property markets.

3. Changing your investment strategy

Too many investors are making 30 years decisions based on the last 30 minutes of news rather than on the fundamentals.

If your aim is to gain financial freedom this is not the right time to change a proven strategy.

Strategic investors do what’s always worked and don’t look for what’s working now.

They buy investment grade properties that will be in continuous strong demand by both owner occupiers and investors in the long term, rather looking for a short-term fix in the next hot spot.

4. The money illusion

Some Sydney investors have seen the values of their properties fall 10% from say $800,000 to $725,000 today.

However many of these investors bought their properties 5 or 6 years ago for $400,000 and rather than losing ten percent, they are in fact eighty percent better off than they were before they started their property journey.

5. Acting on their fears

Of course it’s perfectly normal to feel nervous about the current market downturn – especially when you consider the continual barrage of negative messages in the media we’re being subjected to.

However, acting on your fears irrationally and selling your properties because of the market correction is usually a big mistake.

As I said, don’t lose sight of the fact that you’re investing for your long-term financial independence, so stay invested in the market.

6. Trying to time the market

Sophisticated investors recognise that even the experts can’t time the markets.

Yet some inexperienced investors want to sell up now and get back into the market again when property values pick up.

Problem is most won’t be able to pick the right time and just end up “selling low and buying high” which is the opposite of what they hoped to achieve.

While others just won’t ever buy another investment property.

7. Taking advice from the wrong people

In Australia we seem to have 25 million property experts.

While everyone seems to have an opinion on what’s going to happen to our property markets, the problem is nobody really knows.

Even the media reports are confusing and contradictory.

8. Looking for the next hot spot

Rather than looking for the next hot spot, which usually ends up being the following year’s “not spot”, smart investors look for locations that will outperform the averages in the long term.

I know I look for areas where properties grow at wealth producing rates of return, which has a lot to do with the demographics of the location.

I look for suburbs where the people have incomes that is growing faster than the state averages and I love investing in suburbs that are undergoing gentrification.

9. Looking too frequently at the value of their properties

When the property market is declining, the more often you check the value of your properties, the more likely you’ll become anxious.

If you’re not selling your property it doesn’t really matter what’s happening to property values, does it?

Now I’m not saying: “set and forget.” Of course you need treat your properties like and business and regularly review your portfolio’s performance — but once a year is about right.

10. Thinking they are rational

Most of us think we’re making rational choices but when it comes to financial matters in reality we’re not.

- 8 Charts explaining why we’re in for a great time in property in 2021 - January 5, 2021

- New data shows COVID-19’s impact on Australians’ personal finances, including debt and insurance - December 21, 2020

- 4 key reasons why the property pessimists are changing their minds - October 12, 2020